Multi-Agent Negotiation Framework

Decentralized Energy Markets with Lightning Network Architecture

This multi-agent negotiation platform demonstrates decentralized market mechanisms through autonomous agents conducting peer-to-peer trading without centralized coordination. The system combines Multi-Agent Systems (MAS) with Lightning Network payment channels to create a fully decentralized marketplace framework. While energy markets serve as the primary demonstration domain, the platform's architecture is designed to support various market types including financial instruments, carbon credits, computational resources, and other tradeable commodities.

The framework enables AI agents to autonomously negotiate trades in real-time through bilateral payment channels, eliminating the need for central exchanges or human operators. Each agent implements domain-specific optimization strategies, adapts to market conditions, and responds to external shocks while maintaining system stability through decentralized coordination mechanisms. The energy market implementation demonstrates agents representing solar farms, wind turbines, battery storage, and consumers, but the underlying negotiation protocols are market-agnostic.

Read also the Paper (Revised 2025)

For a comprehensive understanding of the theoretical foundations and technical implementation details, please refer to our research paper:

The paper covers the mathematical foundations of Mean-Field Game Theory, Lightning Network integration, performance analysis, and detailed case studies demonstrating the system's effectiveness in decentralized energy market scenarios.

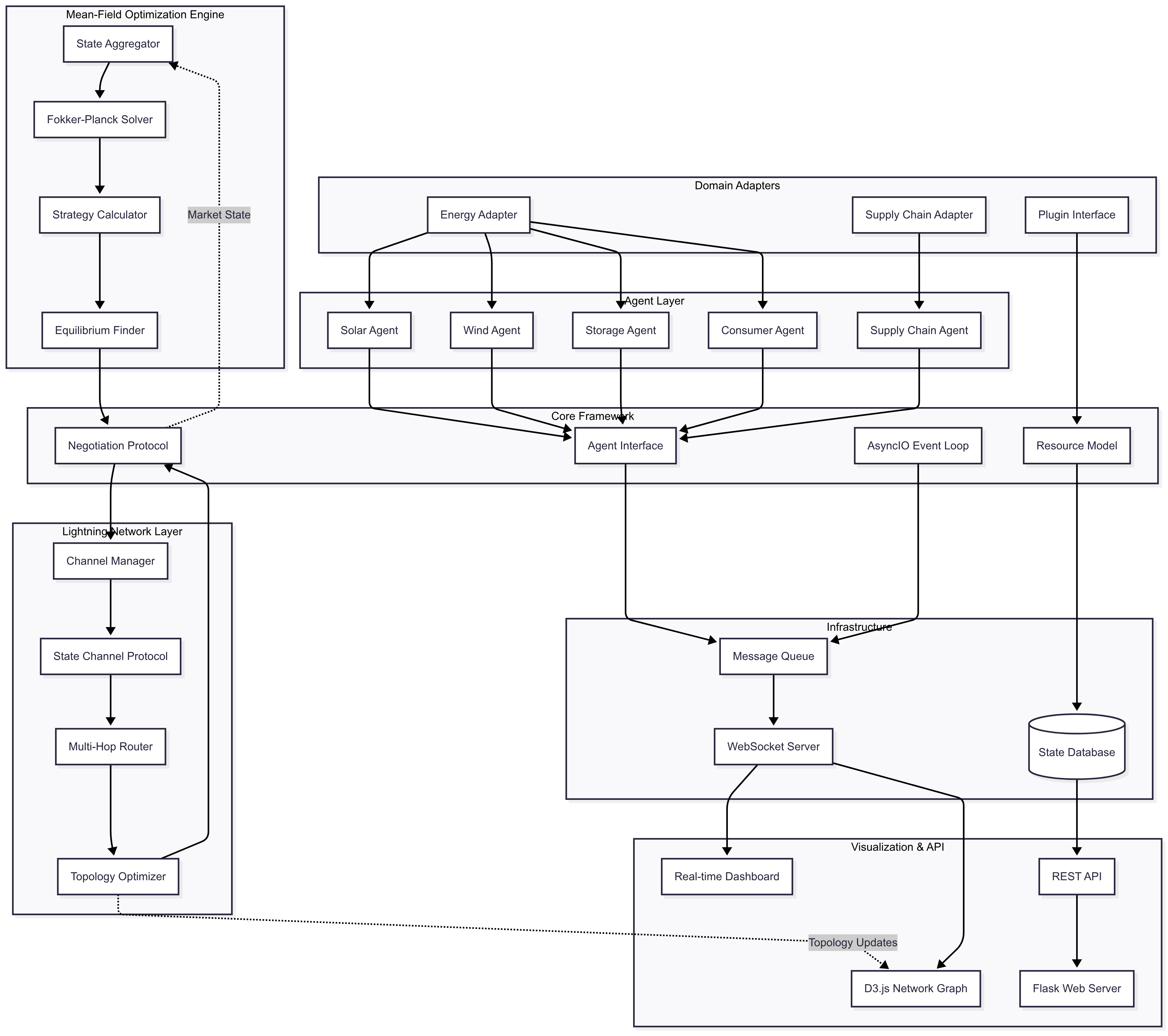

System Architecture

Core Components

- agents/ - Agent implementations with domain-specific logic

- negotiation/ - Lightning Network protocols and bilateral matching

- optimization/ - Mean-field solvers and equilibrium calculations

- market/ - Order book, pricing mechanisms, and settlement

- simulation/ - Environment coordinator and testing framework

- web/ - Real-time dashboard with WebSocket updates

- data/ - State management, models, and persistence

Agent System Design

All agents inherit from agents/base_agent.py and implement domain-specific logic.

Energy agents model physical constraints (generation capacity, storage limits, consumption patterns).

Agents communicate through Lightning Network channels for bilateral negotiation, while Mean-field

optimization reduces computational complexity from O(n²) to O(n).

Decentralized Architecture

Unlike traditional centralized markets, this system enables peer-to-peer energy trading. Agents establish payment channels and negotiate directly, with the Lightning Network handling instant settlements. This eliminates single points of failure and reduces transaction costs.

Dashboard Components

Market Statistics (Top Bar)

- AGENTS_TOTAL: Number of active trading agents in the simulation

- CHANNELS_ACTIVE: Open Lightning Network payment channels

- TRADES_EXECUTED: Cumulative bilateral trades completed

- SUPPLY/DEMAND: Current market balance in MWh (supply/demand)

- MARKET_PRICE: Current clearing price in €/MWh

- SIM_TIME: Simulation time progression (hours:minutes)

These metrics update in real-time via WebSocket connections. Values flash when updated to provide visual feedback.

Control Panel

- EXECUTE: Starts the market simulation with agent initialization and trading

- PAUSE: Pauses the running simulation and resets the environment

The simulation runs for a limited duration (100 steps) with 1-second intervals for demonstration purposes. Production systems would run continuously.

External Shocks System

- DEMAND_SURGE (+100%): Doubles consumer energy demand, simulating heatwaves or economic growth

- DEMAND_DROP (-70%): Reduces demand by 70%, simulating economic downturns or efficiency improvements

- SUPPLY_SURPLUS (+100%): Doubles renewable generation, simulating optimal weather conditions

- SUPPLY_SHORTAGE (-70%): Reduces supply by 70%, simulating equipment failures or poor weather

Only one shock can be active at a time. Shocks create dramatic market imbalances that demonstrate the system's price response mechanisms. When applied, the price chart flashes orange and notifications appear.

Market Price Chart

Real-time price evolution showing market dynamics and shock responses. The chart displays:

- Current Price: Live market clearing price in €/MWh

- Price History: Time series showing price volatility and trends

- Shock Effects: Visual feedback when external shocks are applied

- Market Dynamics: Supply/demand imbalances reflected in price movements

The pricing mechanism includes time-of-day effects, volatility modeling, and mean reversion to prevent unrealistic price spirals. Orange flashing indicates shock application.

Agent Resource Monitor

Visualization of agent resources and trading activity across different agent types:

- Solar Agents: Weather-dependent generation with peak output at noon

- Wind Agents: Variable generation based on wind patterns

- Storage Agents: Battery systems that buy low and sell high

- Consumer Agents: Residential and industrial demand with different patterns

The chart shows resource levels (MWh), financial positions (€), and trading activity for each agent type. This helps understand market participant behavior.

Lightning Network Topology

What is the Lightning Network Topology?

The Lightning Network topology visualization shows the decentralized payment infrastructure that enables instant, low-cost energy trading between agents. This is the heart of the peer-to-peer energy market.

Visual Elements

- Nodes (Circles): Individual energy market participants

- • Solar agents - Orange circles

- • Wind agents - Blue circles

- • Storage agents - Purple circles

- • Consumer agents - Green circles

- Node Size: Proportional to agent's resource capacity or activity level

- Node Position: Dynamic positioning with subtle movement over time

- Connections (Lines): Payment channels between agents

- • White lines - High activity channels (>70% utilization)

- • Green lines - Active negotiations in progress

- • Yellow lines - Brand new negotiations

- • Gray lines - Inactive or low-activity channels

- Line Thickness: Represents channel capacity (thicker = higher capacity)

Dynamic Behavior

- Real-time Updates: Network updates every 0.5-1.5 seconds with new data

- Channel Creation/Closure: New channels open (8% chance per step) and close (5% chance) dynamically

- Negotiation Activity: 30% base chance of negotiation, higher for moderate utilization channels

- Flow Simulation: Random payment flows simulate ongoing energy transactions

- Force Simulation: D3.js physics keeps nodes separated and connections visible

Technical Details

Lightning Network Benefits:

- Instant settlements (no blockchain delays)

- Minimal transaction fees

- Scalable to thousands of participants

- Decentralized (no central authority)

- Privacy preserving

Channel Properties:

- Capacity: 50-200 units

- Initial balance: 50% to each party

- Utilization tracking

- Flow history

Visualization Features:

- Maximize button for full-screen view

- Responsive force simulation

- Color-coded activity states

- Real-time utilization updates

How to Interpret the Topology

Healthy Market Indicators:

- • Many green/yellow active connections

- • Balanced distribution of node types

- • Dynamic channel creation/closure

- • Nodes well-connected without isolation

Market Stress Indicators:

- • Mostly gray inactive connections

- • Isolated nodes with few channels

- • High utilization (all white lines)

- • Rapid channel closure during shocks

Research Applications

- Energy Market Design: Test new market mechanisms and pricing strategies

- Policy Analysis: Evaluate regulatory impacts on market efficiency

- Grid Integration: Study renewable energy integration challenges

- Behavioral Economics: Analyze agent decision-making under uncertainty

- Network Effects: Understand topology impact on market outcomes

Performance Characteristics

- Convergence: Sub-100ms market clearing

- Scalability: Supports 10,000+ agents

- Complexity: O(n) vs O(n²) traditional methods

- Real-time: Live WebSocket updates

- Fault Tolerance: Decentralized, no single point of failure